LLC Operating Agreement - S Corporation

Form for a Single-Member, Manager-Managed LLC with S Corp Tax Status

Running a single-member, manager-managed S Corporation can be a smart choice for many entrepreneurs. Having a solid LLC Operating Agreement is essential to protecting your business and outlining the rules governing your S Corp. With our Operating Agreement template for S Corp LLCs, you can quickly and easily create a legally compliant operating agreement tailored to your unique needs.

This LLC operating agreement template is for a single-member, manager-managed LLC taxed as an S Corp. Here is a list of other operating agreement templates we offer:

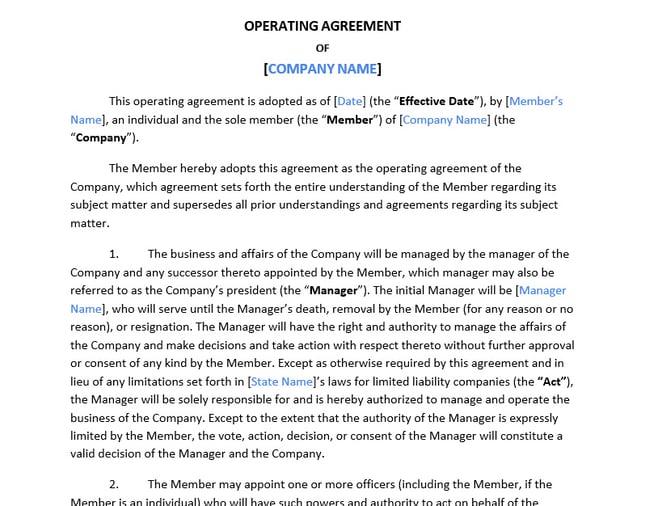

Document Preview

To get started, simply purchase the template and download it to your device. You can then customize it according to your business requirements. Our template includes the following important sections:

- Company Formation: Establishes the name, purpose, and duration of your LLC, along with its principal place of business.

- Taxation: Explains the S Corporation tax election and the member's responsibility for tax filings and payments.

- Capital Contributions: Details the initial contributions made by the member and the process for making additional contributions in the future.

- Distributions: Defines how profits and losses will be allocated and distributed to the member.

- Indemnification and Limitation of Liability: Protects the manager from personal liability for certain actions taken on behalf of the LLC.

- Dissolution: Describes the process and conditions for dissolving the LLC, including the distribution of assets and liabilities.

- Amendments: Specifies the procedure for amending the operating agreement, ensuring flexibility as your business grows.

Some of the benefits of using this single-member, manager-managed operating agreement include:

- The agreement is customizable to fit your unique business needs

- Easy-to-follow, step-by-step instructions

- Compliant with state laws and regulations

- Professionally drafted by legal experts

- Saves time and reduces potential legal disputes

- Protects your personal assets by solidifying the LLC structure

Not sure if you need an Operating Agreement? Learn why these agreements are important -- especially for single-member LLCs.

This form is appropriate for single-member, manager-managed LLCs that have elected to be taxed as an S Corporation with the IRS. If you don't meet all these criteria, these operating agreements are better for you:

- Single-Member Operating Agreement (manager-managed; default tax)

- Single-Member Operating Agreement (member-managed, default tax)

- Multi-Member LLC Operating Agreement

Why Choose Legal GPS for your Legal Contract Templates?

At Legal GPS, we are committed to providing high-quality, legally compliant contract templates that save you time, money, and stress. Our team of legal experts and industry professionals work diligently to ensure our templates are up-to-date with the latest legal requirements while remaining user-friendly and easily customizable. We offer a 30-day money-back guarantee if you aren't satisfied.

Frequently Asked Questions

Why do I need an operating agreement for a single-member LLC?

It provides legal documentation that you are operating your business as a separate entity, which can be critical for protecting your personal assets from business liabilities. It also clarifies the rules and structure of your business for legal or financial entities.

What should be included in a single-member LLC operating agreement?

The agreement should cover the LLC's name and purpose, the member's contributions, how profits and losses will be handled, management structure, and any rules for changes or dissolution of the LLC.

Is an operating agreement required for a single-member LLC?

This depends on the state. While not all states require an operating agreement for single-member LLCs, it is highly recommended to have one for legal protection and operational clarity.

How does an operating agreement protect me if I’m the only member?

It formalizes the separation between your personal and business finances and liabilities, helps establish your LLC as a legitimate business entity for banks and creditors, and can offer documentation of your business structure in legal situations.

Does an operating agreement need to be filed with the state?

Typically, no. Operating agreements are internal documents that you should keep with your business records. However, some states might require you to have one on file or present it upon request.

Can I change my operating agreement?

Yes, you can amend your operating agreement as your business grows or changes. It's important to have a process for amendments outlined within the agreement itself.

What happens if I don’t have an operating agreement for my single-member LLC?

Without an operating agreement, your LLC may be governed by the default state laws, which might not be in your best interest. It could also make it harder to prove the separation between your personal and business assets.

How does an operating agreement affect taxes for a single-member LLC?

The operating agreement itself doesn’t directly affect taxes, but it reinforces your LLC’s structure. Single-member LLCs are typically taxed as sole proprietorships by default, with the option to elect corporate taxation.