Multi-Member LLC Operating Agreement

Form for a Member-Managed LLC with more than one owner

Starting a multi-member LLC? Our professionally crafted Multi-Member LLC Operating Agreement template provides you with the essential framework to define the ownership, management, and operational structure of your business. Save time and money by using our easy-to-customize template, designed by legal experts to protect your interests and ensure compliance with relevant laws and regulations.

| Premium Template Single-use Template |

Legal GPS Pro Unlimited Access, Best Value |

|

|

|

$35

|

$39/ month

|

| Buy Template | Explore Legal GPS Pro |

| Trusted by 1000+ businesses | |

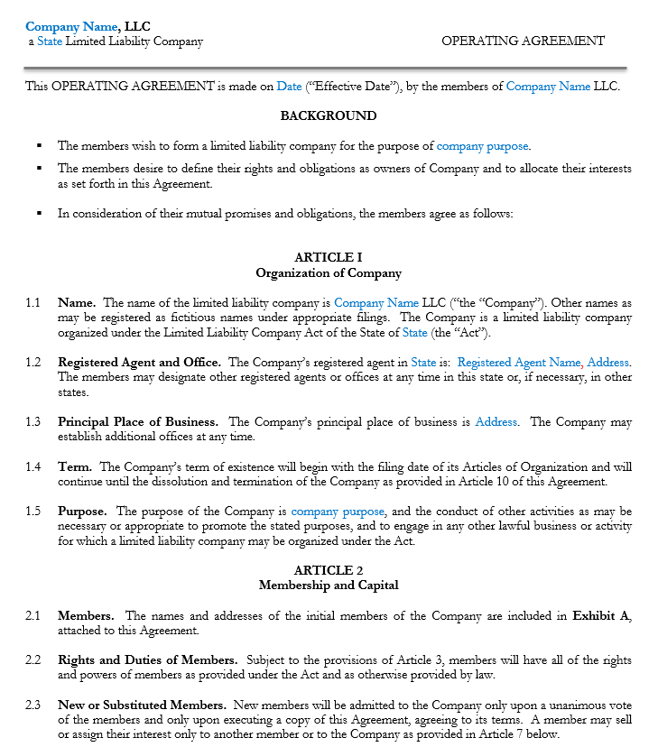

Document Preview

To get started, simply purchase the template and download it to your device. You can then customize it according to your business requirements. Our template includes the following important sections:

- Company Formation: Establishes the name, purpose, and duration of your LLC, along with its principal place of business.

- Taxation: Explains the S Corporation tax election and the member's responsibility for tax filings and payments.

- Capital Contributions: Details the initial contributions made by the member and the process for making additional contributions in the future.

- Distributions: Defines how profits and losses will be allocated and distributed to the member.

- Indemnification and Limitation of Liability: Protects the manager from personal liability for certain actions taken on behalf of the LLC.

- Dissolution: Describes the process and conditions for dissolving the LLC, including the distribution of assets and liabilities.

- Amendments: Specifies the procedure for amending the operating agreement, ensuring flexibility as your business grows.

Some of the benefits of using this single-member, manager-managed operating agreement include:

- The agreement is customizable to fit your unique business needs

- Easy-to-follow, step-by-step instructions

- Compliant with state laws and regulations

- Professionally drafted by legal experts

- Saves time and reduces potential legal disputes

- Protects your personal assets by solidifying the LLC structure

| Premium Template Single-use Template |

Legal GPS Pro Unlimited Access, Best Value |

|

|

|

$35

|

$39/ month

|

| Buy Template | Explore Legal GPS Pro |

| Trusted by 1000+ businesses | |

Not sure if you need an Operating Agreement? Learn why these agreements are important -- especially for single-member LLCs.

This LLC operating agreement template is for a multi-member, member-managed LLC. Here is a list of other operating agreement templates we offer:

- Single-Member LLC Operating Agreement (manager-managed)

- Single-Member LLC Operating Agreement (member-managed)

- Single-Member LLC Operating Agreement (manager-managed; S Corp)

- Single-Member LLC Operating Agreement (member-managed, S Corp)

- Multi-Member LLC Operating Agreement (member-managed; S Corp)

Why Choose Legal GPS for your Legal Contract Templates?

At Legal GPS, we are committed to providing high-quality, legally compliant contract templates that save you time, money, and stress. Our team of legal experts and industry professionals work diligently to ensure our templates are up-to-date with the latest legal requirements while remaining user-friendly and easily customizable. We offer a 30-day money-back guarantee if you aren't satisfied.

Frequently Asked Questions

Why is an operating agreement important for a multi-member LLC?

An operating agreement is crucial because it establishes clear rules and expectations for the LLC's operations, preventing misunderstandings among members. It also provides legal protection by reinforcing the separation between the members' personal assets and the business's liabilities.

What should be included in a multi-member LLC operating agreement?

The agreement should cover the LLC's name and purpose, members' contributions, profit and loss distribution, management structure and voting rights, rules for adding or removing members, and procedures for dissolving the LLC.

Is an operating agreement required for a multi-member LLC?

While not all states require an operating agreement, having one is highly recommended for clarity, legal protection, and to ensure the business runs smoothly according to the members' agreements.

How does an operating agreement protect the members of an LLC?

It outlines the financial and management structure of the LLC, helps in the separation of personal and business liabilities, and provides a clear roadmap for handling disputes, distributions, and the dissolution of the company.

Does an operating agreement need to be filed with the state?

In most cases, the operating agreement does not need to be filed with the state. However, it should be kept on file with the company's records and updated as needed.

Can a multi-member LLC operating agreement be changed?

Yes, the agreement can be amended if necessary. The process for making amendments should be outlined within the original agreement, typically requiring a majority vote or consensus among the members.

What happens if a multi-member LLC doesn’t have an operating agreement?

Without an operating agreement, the LLC would be governed by the default state laws, which may not align with the members' wishes or interests. This could lead to disputes and complications in the management and financial arrangements of the LLC.

How does an operating agreement affect taxes for a multi-member LLC?

While the operating agreement itself doesn’t dictate tax treatment, it clarifies the LLC’s structure and profit-sharing, which is essential for tax purposes. Multi-member LLCs are typically taxed as partnerships by default but can choose to be taxed as a corporation.