Assignment of LLC Company Interest to Revocable Trust

Transferring your LLC ownership to a revocable trust? Our Assignment of LLC Company Interest to Revocable Trust Template simplifies the process. This attorney-drafted document legally transfers your membership interest to your trust, helping you avoid probate and align your business with your estate plan.

Last Updated: Apr. 28, 2025

Why Use Our Assignment of LLC Company Interest to Revocable Trust Template?

Ensure Your LLC Is Covered by Your Estate Plan

-

Attorney-Drafted: Written by experienced business and estate planning lawyers.

-

Direct Transfer to Trust: Legally assigns your ownership interest to your revocable trust.

-

Avoids Probate: Ensures your business interest passes seamlessly to your beneficiaries.

Aligns with Your Legal Documents

-

Estate Planning Friendly: Works alongside your revocable trust, will, and LLC operating agreement.

-

Supports Long-Term Planning: Keeps your business within the structure of your living trust.

-

Adaptable to Most Trusts: Designed to work with common revocable trust setups.

Easy to Complete and Implement

-

Editable Word Format: Customize with your LLC and trust information in minutes.

-

Simple Language: Clear and straightforward provisions for fast completion.

-

Optional Consent Clause: Includes space for member or manager approval if required.

| Premium Template Single-use Template |

Legal GPS Pro Unlimited Access, Best Value |

|

|

|

$35

|

$39/ month

|

| Buy Template | Explore Legal GPS Pro |

| Trusted by 1000+ businesses | |

How to Purchase and Use the Assignment to Revocable Trust

🛒 Step 1: Complete Your Purchase ($35 per Template)

Add the Assignment of LLC Company Interest to Revocable Trust to your cart and check out securely. You'll receive the template via email right away.

📥 Step 2: Download and Customize

Open the document in Microsoft Word and fill in your LLC details, trust name, and trustee information.

👥 Step 3: Review with Your Attorney and Co-Members

Make sure it aligns with your trust and complies with your LLC operating agreement. Some LLCs may require member consent.

✍️ Step 4: Sign and File

Sign the agreement and store it with your trust records and LLC documentation. If required, share it with your registered agent or other members.

🎯 Ready to Align Your LLC with Your Trust?

Make your estate plan complete—get the Assignment of LLC Company Interest to Revocable Trust today.

Key Features of the Assignment to Revocable Trust Template

- Trust Transfer Language: Clearly assigns ownership interest to your revocable trust.

- Trustee Acceptance: Acknowledges the trustee’s acceptance of the assigned interest.

- Consent Provisions (Optional): Includes language for obtaining approval if required.

- Execution Section: Includes signature lines and optional notary fields.

- Compatible with Estate Plans: Designed to work with most revocable living trusts.

Benefits of Our Assignment to Revocable Trust Template

Protect Your Legacy

-

Avoid Probate: Ensure your LLC interest transfers through your trust, not the courts.

-

Maintain Control: Keep ownership in your trust without impacting LLC operations.

-

Estate Planning Alignment: Keeps all your assets under one estate planning structure.

Efficient and Affordable

-

Instant Access: Download immediately after purchase.

-

No Legal Guesswork: Use our attorney-crafted language with confidence.

-

Update Anytime: Reuse and revise as needed with new trusts or LLCs.

| Premium Template Single-use Template |

Legal GPS Pro Unlimited Access, Best Value |

|

|

|

$35

|

$39/ month

|

| Buy Template | Explore Legal GPS Pro |

| Trusted by 1000+ businesses | |

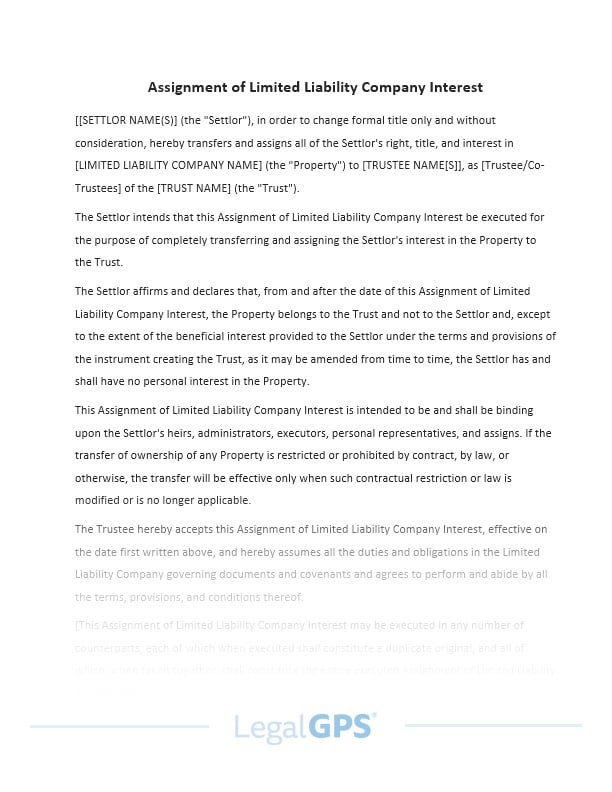

Quick Look: Assignment of LLC Interest to Revocable Trust

| Feature | What It Means for You |

|---|---|

| Attorney-Drafted Agreement | Legally sound and estate-plan friendly |

| Trust Transfer Language | Formally assigns ownership to your revocable trust |

| Trustee Acceptance Section | Documents trustee’s acknowledgment of the transfer |

| Consent Clause (Optional) | Includes space for required LLC approvals |

| Editable Word Format | Quickly fill in your information and save |

| Execution Provisions | Signatures and optional notarization section |

Frequently Asked Questions

Q: Why would I assign my LLC interest to a trust?

A: To ensure the interest is distributed according to your estate plan and avoids probate. It’s a common step in aligning your assets with your trust.

Q: Can I assign my LLC interest without other members’ consent?

A: That depends on your operating agreement. This template includes optional consent language in case approval is needed.

Q: Will this affect day-to-day LLC operations?

A: No, assigning your interest to a revocable trust generally doesn’t impact how the LLC is run unless otherwise specified in the operating agreement.

Q: Should my trust be revocable?

A: This template is designed for revocable living trusts, not irrevocable or testamentary trusts.

Q: Do I need a lawyer to use this?

A: The template is DIY-friendly, but it's wise to review it with your estate planning or business attorney for peace of mind.

Why This Agreement Matters

Completes Your Estate Plan: Keeps your LLC interest within your trust’s structure.

Avoids Probate: Ensures smooth succession of ownership without court involvement.

Supports LLC Continuity: Helps protect your business from unexpected ownership gaps.

Easy to Update: Reuse and revise as your trust or LLC structure evolves.

| Premium Template Single-use Template |

Legal GPS Pro Unlimited Access, Best Value |

|

|

|

$35

|

$39/ month

|

| Buy Template | Explore Legal GPS Pro |

| Trusted by 1000+ businesses | |